PBM 101: Understanding Spread Pricing and Its Impact on Plan Costs

There is no shortage of questions surrounding pharmacy benefit business models, especially when medication costs continue to rise. One major area of concern centers on a practice that often goes unnoticed or not understood: spread pricing.

Though rarely visible in contracts, spread pricing can significantly affect total plan costs. For consultants advising on benefit strategy, spread introduces added complexity. It makes it harder to confirm the degree to which a pharmacy benefit manager’s (PBMs) incentives are aligned with clients’ goals.

Our blog explains how spread pricing works, how PBMs deploy it and why full transparency is becoming a core expectation for clients seeking true lowest-net-cost strategies.

The role of spread pricing

In the PBM industry, spread refers to a difference between what the PBM charges a plan sponsor or health plan and what it pays the pharmacy. The PBM keeps that difference as profit, usually without disclosing the underlying drug cost or how much was retained.

This practice is common in traditional PBM contracts. For example, a PBM may pay a pharmacy $80 for a prescription but bill the plan sponsor $100. The $20 difference is the spread, retained by the PBM as revenue. While this is illustrative, and the amount might seem small on a single claim, the cumulative impact across tens of thousands or millions of prescriptions is significant. Moreover, the spread that is created on higher-priced specialty medications can be much higher, creating significant revenue opportunity for PBMs that result in cost challenges for plans and members.

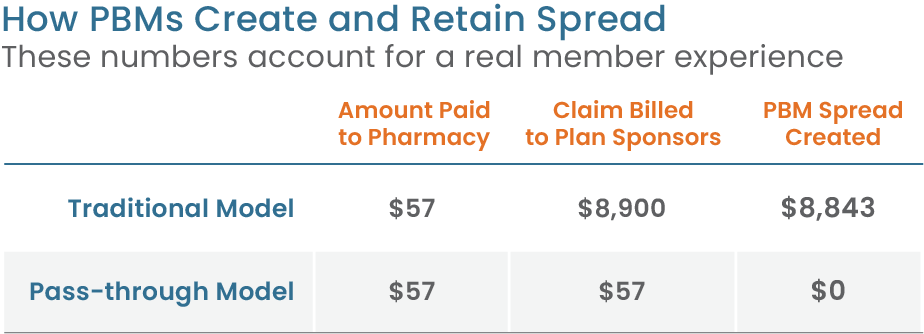

Alternatively, in pass-through contracts, PBMs do not make any spread on prescription claims. What is paid to the pharmacy equals the claim billed to the plan sponsor or health plan.

This transparent model can result in significantly lower costs, as illustrated in a Navitus member story, where a cancer medication priced at $8,900 under a traditional PBM model was just $57 through Navitus.

The impact of spread on plan sponsors and members

Limited visibility into prescription pricing creates major challenges for plan sponsors trying to control drug costs. Without a clear line of sight into what pharmacies are paid versus what’s billed to the plan, employers often end up responding to rising expenses reactively, rather than proactively managing their benefits.

As pharmacy expenses rise, plan sponsors may be forced to make difficult decisions, such as narrowing drug coverage, increasing premiums or raising copays to offset rising pharmacy costs.

These types of benefit changes can also impact members. Higher costs or reduced coverage may lead to delayed treatments or poor medication adherence, both of which can negatively affect long-term health outcomes.

Growing concern about spread-based models

The primary concern with spread pricing is that it ultimately leads to inflated drug costs. When PBMs profit from the difference between what they pay and what they charge, they are financially rewarded for maintaining or increasing that margin, even when lower-cost alternatives are available.

These practices have drawn increased attention from the media, legislators and federal regulators. In 2022, the Federal Trade Commission (FTC) launched an investigation into several major PBMs, citing concerns over spread pricing, rebate retention and reduced pharmacy reimbursements.

Interim findings published in 2024 and 2025 confirmed that PBMs have enormous influence over drug availability and pricing, impacting both affordability and access to medications.

Employers, plan sponsors and health plans need to stay proactive in evaluating how pharmacy benefit contracts are structured and implemented. The most effective way to address hidden costs is by partnering with a PBM that prioritizes total drug cost management and provides full transparency into how plan dollars are spent.

Navitus: a transparent alternative to traditional pricing models

As demand for transparency grows, more organizations are reevaluating whether their current PBMs truly support their financial and clinical goals.

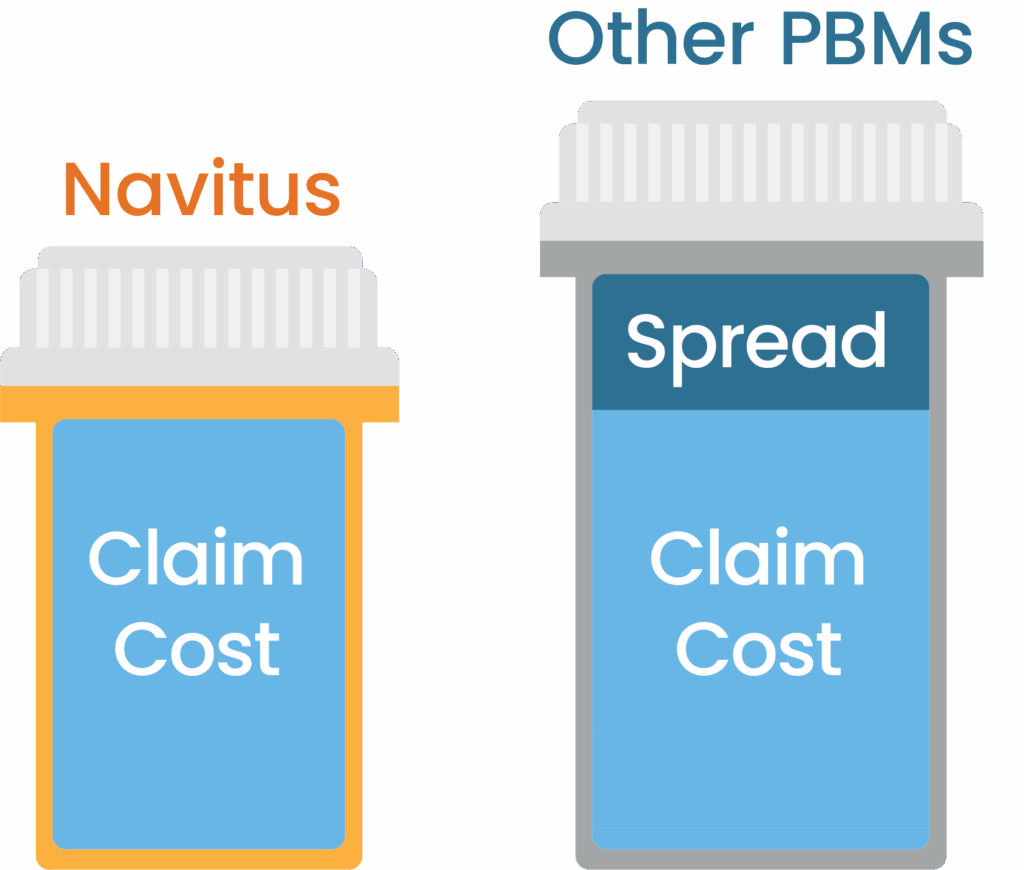

Navitus operates under a 100% pass-through model that removes spread and discloses all revenue sources. Here’s what it looks like in practice:

- All negotiated discounts, fees and rebates are passed through directly to clients

- Clients have full visibility into pricing, reimbursement and rebate data, down to the individual claim level

- Formularies are designed to deliver lowest net cost and maximize clinical value

- Incentives are aligned around cost control and better health outcomes (Learn more in our latest blog: PBM 101: How to Evaluate Your PBM)

Because our compensation derives from a flat administrative fee, our focus stays on what matters most: reducing total net cost and improving patient health.

If you want to move away from spread-based pricing and take control of your pharmacy benefits, contact us at [email protected] to see how our pass-through model gets it done.

Stay Informed and Connected

Receive expert insights, healthcare tips, and important updates on pharmacy benefits, drug recalls, and more—straight to your inbox.

Navigating with a trusted partner

Now Available: 9th Annual Drug Trend Report

Our Drug Trend Report provides a clear view of the trends shaping pharmacy benefits today, along with strategies that are delivering real savings without compromising care.