The Role of Rebates in Pharmacy Benefits

When it comes to pharmacy benefits, few topics spark as much debate and controversy as rebates. Often positioned as a key source of savings, rebates have become central to plan cost strategies. However, for many plan sponsors and consultants, the reality isn’t always clear-cut.

Rebates were originally created to help lower the net cost of prescription drugs. Today, they have evolved into a system that is difficult to track, compare and fully understand. And while rebate totals might look impressive, they don’t always translate into lower pharmacy costs.

In this blog, we’ll break down how rebates work, why they’ve come under increased scrutiny and how transparency — especially from your pharmacy benefit manager (PBM) — can help your organization truly lower prescription drug costs.

Understanding rebates

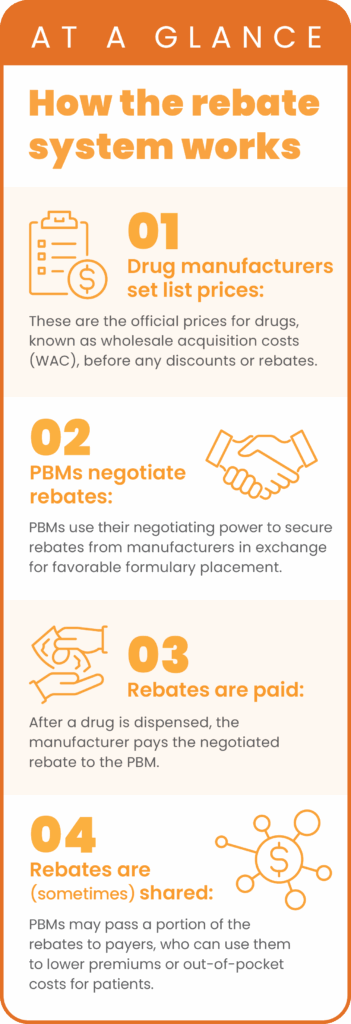

At a high level, a rebate is a discount on the medication that a pharmaceutical manufacturer gives a PBM in return for agreeing to include their drug on the formulary for a pharmacy benefit plan.

Over time, rebate structures have become more varied and complex. While there are many types — access rebates, positioning rebates, performance-based rebates, market-share and manufacturer incentives, and even indication- and outcomes-based arrangements — most plan sponsors only see a single rebate figure.

To add to the complexity, not all PBMs define or report rebates in the same way. Some may only disclose a portion of the total value negotiated with manufacturers, while others may group multiple revenue streams under the “rebate” umbrella.

This lack of consistency and transparency makes it difficult for plan sponsors to evaluate if they’re truly benefiting.

Rebates and the illusion of savings

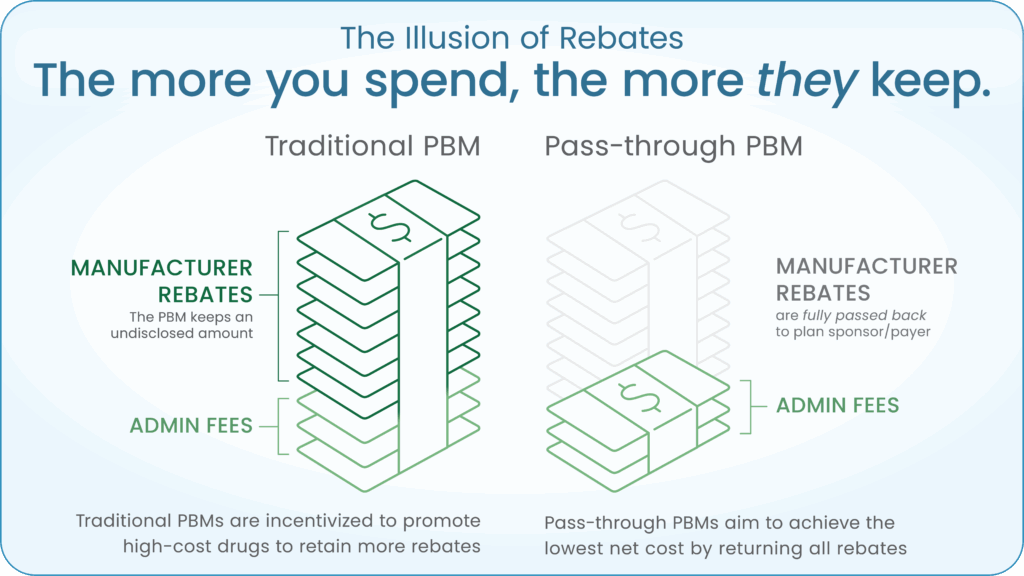

It’s a common misconception that higher rebates automatically lead to lower pharmacy costs. While large rebate checks may look appealing, they often require higher upfront spending.

Rebates are usually based on a percentage of a drug’s list price, which means the higher the price, the bigger the rebate. That setup gives traditional PBMs a financial incentive to favor more expensive, brand-name medications, even when lower-cost alternatives could reduce total spending. As a result, plans may spend more overall, while members face higher out-of-pocket costs and limited formulary flexibility.

Increasing scrutiny and regulatory concerns

The growing complexity of rebate practices hasn’t gone unnoticed. The Federal Trade Commission is currently investigating whether the largest PBMs have structured rebates in ways that inflate drug prices, restrict competition and ultimately raise costs for plan sponsors and patients.1

One key allegation: certain major PBMs may have favored expensive, highly rebated insulins over lower-cost alternatives, potentially increasing out-of-pocket costs for both plan sponsors and patients, especially those with high deductibles.

As concerns like these continue to gain attention, there’s growing momentum behind new transparency measures. For example, proposed regulations would require PBMs to pass a larger share of manufacturer rebates, typically 85% or more, directly to members at the pharmacy counter, reducing out-of-pocket costs at the time of purchase.

For a deeper dive into these and other emerging trends, read our latest blog on regulatory shifts in pharmacy benefit management – Legal Ease: Key Legislative & Regulatory Updates Impacting Plan Sponsors in 2025

Moving beyond rebates to true savings

As scrutiny increases, so does the demand for transparency. Without full visibility into how rebates are defined and applied, it becomes challenging for plan sponsors to assess whether they are truly optimizing total drug spend or simply maximizing rebate volume.

The most effective way to lower pharmacy costs is to focus on total net cost, supported by a transparent PBM partnership that puts your plan’s interests first.

That’s where Navitus stands out.

As a fully transparent, 100% pass-through PBM, Navitus returns all manufacturer rebates directly to the plan sponsor. There are no retained earnings, no hidden spread and no ambiguous contract language. Rather than chasing the highest rebate, we work with clients to achieve the lowest net cost through:

Lowest-net-cost formulary decisions: Our formularies are designed to prioritize clinically appropriate generics and brand alternatives that consistently reduce per member per month (PMPM) expenses.

Specialty pharmacy support: Lumicera Health Services, our full-service specialty pharmacy, supports patients with clinical guidance while helping plans manage high-cost medications. Its unique acquisition cost-plus pricing model ensures plan sponsors receive near real-time price adjustments when lower-cost medications become available.

Transparent financial reporting: We provide full visibility into rebates, administrative fees and contract terms, giving plan sponsors a clear view into how their pharmacy benefit is performing.

The most effective strategy focuses on achieving the lowest net cost: what the plan pays after all discounts, incentives and rebates are applied. The true savings don’t come from the size of the rebate, but from reducing the total cost of care.

The bigger picture

Understanding rebates is only the first step. Partnering with a transparent PBM turns insights into action, helping your organization lower overall spend, improve outcomes and deliver more value to members.

Contact us at [email protected] to learn how we can help drive meaningful savings for your organization.

Interested in additional PBM 101 insights?

Check out our previous blog: PBM 101: Understanding Transparency for Better Pharmacy Benefits

References

1. Federal Trade Commission. FTC releases Second Interim Staff Report on prescription drug middlemen. Published January 14, 2025. Accessed August 1, 2025. https://www.ftc.gov/news-events/news/press-releases/2025/01/ftc-releases-second-interim-staff-report-prescription-drug-middlemen

Stay Informed and Connected

Receive expert insights, healthcare tips, and important updates on pharmacy benefits, drug recalls, and more—straight to your inbox.

Navigating with a trusted partner

Now Available: 9th Annual Drug Trend Report

Our Drug Trend Report provides a clear view of the trends shaping pharmacy benefits today, along with strategies that are delivering real savings without compromising care.