Creating a More Successful PBM-Client Relationship

Finding the Right PBM Partner

Finding a prescription benefit manager (PBM) that offers savings, flexibility and alignment to the plan sponsor’s goals can be a challenge. With the availability of varying models, ranging from traditional to pass-through, shopping for the right PBM comes down to understand the contract details. Traditional PBMs may seem transparent. However, in mining their details, their complex contracts can include hidden revenue streams, lack flexibility, and contain confusing definitions that can be costly. Pass-through PBMs offer an alternative—with complete revenue visibility, upfront fees, flexibility, client-friendly contracts, and full audit rights down to the claim level.

San Diego Electrical Health & Welfare Trust (the Trust) experienced this situation first-hand. In working through a contract renewal with its former PBM, the Trust and its consultant uncovered questionable contract details. Through further evaluation, the Trust realized its PBM lacked transparency and flexibility, leaving them to wonder if they were receiving all the available savings.

Looking at PBMs through a new lens, the Trust went out to bid, carefully scrutinizing PBMs based on their models and contract language. Their goal: complete transparency and pass through to reduce costs.

The Trust expected its new PBM partner be committed to full disclosure, complete pass-through, and most importantly, protecting the Trust’s interests. During procurement, they discovered that many PBMs claim transparency and pass-through of all savings. Based on the Trust’s experience, this is just not the case. Integrity and conviction are the standards by which the Trust operates, and it insisted on the same values of its PBM. Consequently, the Trust selected Navitus.

Collaborating on Goals

Understanding the Trust’s desire to be fully engaged in its pharmacy benefit, offer quality programs, and deliver cost-saving measures that reduce expenses and improve member well-being, Navitus built a customized program to meet the Trust’s needs. The process started with a clear and exact contract that aligned to the Trust’s goals. In keeping with its principle of full transparency, Navitus offered 360-degree operational and financial transparency for greater clarity into cost and savings opportunities. Then Navitus, through its robust reporting, offered the Trust unrestricted insight into its data to provide guidance in the right direction and unlimited flexibility to improve benefit performance.

Delivering results

The collaboration between the Trust and Navitus resulted in an impressive first year. Trust members are enjoying a rich pharmacy benefit after experiencing a seamless implementation. Membership increased by more than 500 members, yet the total claim count decreased by 3% — solid proof that Navitus does not increase claims volume to drive up revenue.

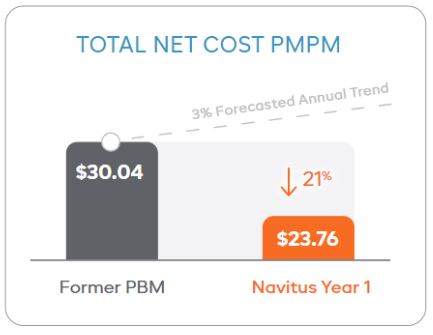

In addition, the Trust’s total net cost per member per month (PMPM) decreased by 21% in the first year – from $30.04 down to $23.76. The Trust also avoided unnecessary costs that would have been unavailable through its incumbent PBM. As illustrated, its trend would have continued to accelerate by 3.2%, based on the PBM’s national published trend. With Navitus, the Trust experienced a substantial decrease in total net cost PMPM in the first year.

We are thrilled to not only have a fair contract, but also have access into our PBM’s manufacturer and network contracts, with audit rights to the claim level. With this insight into Navitus’ operations and access to data, I am able to make sensible decisions with the best interest of the Trust in mind.

Matt Morfoot, Administrative Manager, San Diego Electrical HEalth & Welfare Trust

Getting started

Want to make a great impact towards lowering your pharmacy benefits? Contact us at [email protected] to find out how you can take back control and start saving on your pharmacy benefits today.

Stay Informed and Connected

Receive expert insights, healthcare tips, and important updates on pharmacy benefits, drug recalls, and more—straight to your inbox.

Navigating with a trusted partner

Now Available: 9th Annual Drug Trend Report

Our Drug Trend Report provides a clear view of the trends shaping pharmacy benefits today, along with strategies that are delivering real savings without compromising care.