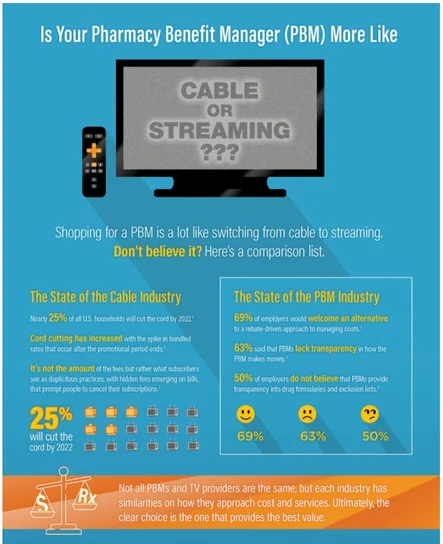

Is Your PBM More Like Cable or Streaming?

Deciding to switch service providers can be difficult, whether it’s your cable or your pharmacy benefit manager. But sometimes it’s necessary.

If someone had asked you ten years ago if you’d ever leave cable, you probably would have laughed. Flash forward to 2021, where the number of people who are ditching cable for streaming services like Netflix, Hulu or Sling is growing more rapidly than anyone expected. In fact, it was recently forecasted that nearly 25% of all U.S. households will cut the cord by 2022.1

So why are more people ditching their cable? And, what does this have to do with pharmacy benefit managers (PBMs)? Just like consumers cutting the cord with their cable providers, plan sponsors are trading in their traditional PBMs for a better solution, a pass-through PBM.

Now, let’s dig deeper into a few reasons why these shifts are happening.

SKYROCKETING PRICES

It’s no surprise here, according to a Consumer Reports study, 62% of respondents who cut the cord on cable said they did so because of increasing prices.2 Most of us have called the cable company after noticing that our once affordable bill, which has been going up little by little, has now quickly spiraled out of control.

Frustrated, the research process begins and low and behold, we find a better, more affordable option. Confronted with this information, the current provider comes back with a much similar or even better offering. Rather than switching, you take the bait and stay. This process often repeats itself.

Sound familiar? Just like the cable provider example above, a traditional (aka spread) PBM may operate this way. Let’s take formulary management for example. In most evaluations, it’s assumed that each PBM is using the same formulary. However, since every PBM has a different business model, each will recommend a different product mix or formulary.

50% of employers do not believe that PBMs provide transparency into formularies and exclusion lists.3

A traditional PBM may recommend a rebate focused (rebate chasing) formulary. This type of formulary focuses on higher cost drugs with big rebates. Big rebates appear to equate to more ‘savings’ but you may need to spend more to get more rebates, which may not cost less in the long run. Traditional PBMs may do this as part of their revenue structure/business strategy, since larger rebates look better on paper.

A pass-through PBM recommends a lowest-net-cost formulary that provides clinically sound, cost-effective alternatives, such as generics or less expensive brands, to create a lower cost drug mix. It uses rebates and a lower average wholesale price (AWP) starting point to lower all-in PMPM (per member per month) costs. Pass-through PBMs do not earn revenue on the drugs in a formulary so they can recommend lower cost options.

Approached about this lowest-net-cost methodology, the traditional PBM, just like the cable provider, agrees to provide a similar or even better option that appears to result in more savings for the plan sponsor.

Whether it’s your cable provider or your pharmacy benefits partner, the question you should ask yourself is, “why didn’t they come out with the lower cost option initially if it was going to save me more money?”

THE BOTTOM LINE

It’s nearly impossible for consumers to find out the cable package’s full cost before they get locked into a contract — and cable companies count on this. When you visit a cable TV provider’s website, the price you see isn’t the price you pay. Hidden fees such as equipment charges, activation fees, broadcast fees, etc. continue to drive up consumer bills.

In a traditional model, zero admin fees typically don’t mean zero dollars to administer your plan. They often charge separate fees for programs such as formulary customization, prior authorization (PA), step therapy (ST), quantity limits (QL) and any add-on services. Add-on items may cost plan sponsors more in the long run since traditional PBMs use this a la carte approach to generate revenue.

In a pass-through model, an admin fee exists to cover all the services needed to administer the plan including formulary customization, PA, ST and QL. This model is similar to streaming providers where, what you see is the price you pay. No surprises. Subscribing to Hulu + Live TV costs about $54.99 per month4 — the same rate that’s advertised on its website. The same applies to your per member per month (PMPM) administrative fee from your pass-through PBM.

Streaming services like Netflix, Amazon Prime and Hulu disrupted the cable industry and introduced us to a better solution to meet our needs. In the beginning, we were all a little skeptical if the deal was a little too good to be true. Could we really save this much money? Would our family members be upset about the change? What if things didn’t work out?

Plan sponsors who are considering changing PBMs, have these same questions. When it comes to pharmacy benefit managers, knowing their business model and revenue source will help you choose the right PBM and make informed benefit plan decisions to meet your goals. Each PBM is different, and its business model can definitely impact your bottom line costs.

Want to know more? Download our infographic!

Sutton, K. Cord-Cutters by 2022, According to EMarketer. ADweek. https://www.adweek.com/tv-video/nearly-25-of-us-households-will-be-cord-cutters-by-2022-according-to-emarketer/ Published August 6, 2019. Accessed May 3, 2020.

Fitzgerald, T. Why Are More People Cord Cutting? It’s Not Just About Pricing. Forbes. https://www.forbes.com/sites/tonifitzgerald/2019/09/19/why-are-more-people-cord-cuttingits-not-just-about-pricing/ Published September 19, 2019. Accessed May 3, 2020.

Toward Better Value: Employer Perspectives on What’s Wrong with Prescription Benefit Management and How to Fix it, National Pharmaceutical Council, 2017.

Current pricing as of December 8, 2020. www.hulu.com/live-tv.

Stay Informed and Connected

Receive expert insights, healthcare tips, and important updates on pharmacy benefits, drug recalls, and more—straight to your inbox.

Navigating with a trusted partner

Now Available: 9th Annual Drug Trend Report

Our Drug Trend Report provides a clear view of the trends shaping pharmacy benefits today, along with strategies that are delivering real savings without compromising care.