2024 Drug Trend Report – Five Key Takeaways

Our 2024 Drug Trend Report reveals how plan sponsors have navigated inflationary pressures, utilization increases and breakthrough therapies, while still controlling costs through transparency and proactive management. All of which are needed more than ever, as overall health care spending for 2024 was nearly $4.9 trillion.1 And one of the fastest-growing components, prescription drug spending, rose to $487 billion. That’s an 11.4% increase over the previous year.

So what’s motivating these trends and how is Navitus working harder to drive the lowest net cost?

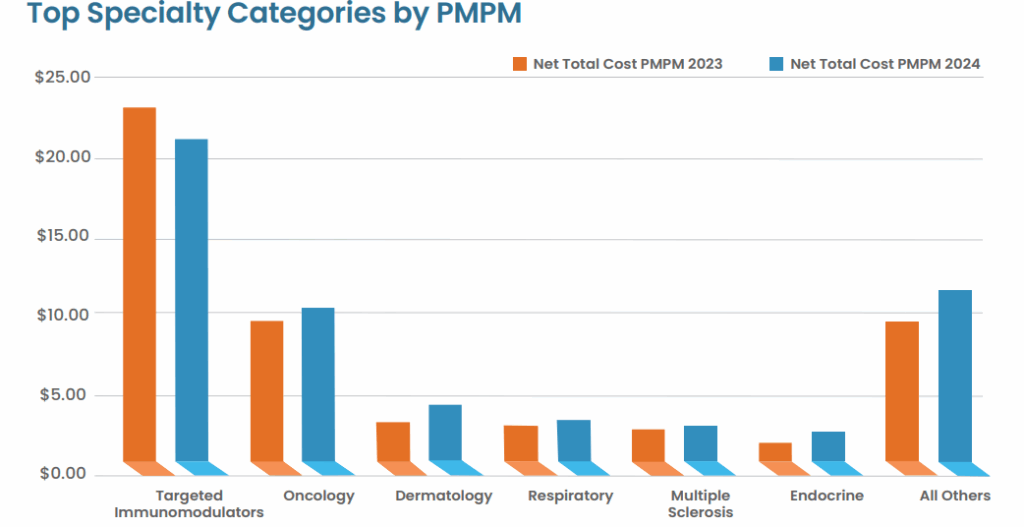

Specialty Drug Spend Continues to Dominate

Specialty medications, which are high-cost, complex, and require special handling, monitoring or administration, saw their utilization increase by 12%. Even more eye-opening, approximately 75% of new drug approvals have been for specialty or medical specialty agents, and that trend is expected to continue in the next two years.

As the market’s fastest-growing cost drivers, specialty treatments demand tailored strategies across benefits, formularies and clinical oversight. And while they accounted for a large portion of drug spend due to increased utilization and high-cost therapies, they only contributed to 2% of all scripts filled. In addition to their high price tag, specialty agents received indication expansions, meaning treatment guidelines recommended them as earlier lines of therapy, further driving utilization trends.

For plan sponsors, managing specialty costs requires integrated oversight across both pharmacy and medical benefits, which you can learn more about here: Medical Specialty Drug Management.

Biosimilars Are Gaining Traction

Biosimilars, which swap brand-name biologics for lower-cost, equally effective medications, are one of the most impactful levers that plan sponsors can pull to manage specialty drug spend, truly delivering on their cost-saving promises.

The growing adoption of biosimilars created substantial cost-saving opportunities across multiple drug classes:

- Biosimilars delivered $315 million in savings with a 60% reduction in Humira costs

- The launch of biosimilar alternatives in 2023 significantly changed the landscape of the category as lower-cost options were added to formulary

- 2024 led the second straight year of declining net cost in the targeted immunomodulators (TIMs) category due to the influence of biosimilars and increased competition

Understanding the power of this change for our partners and clients, Navitus added Stelara biosimilars to formulary as of April 2025, and removed the brand product from formulary July 1, 2025. Forecast annualized net cost savings for clients is $120M.

Chronic Condition Management Is a Cost Driver

Non-specialty therapies remained areas of growth. GLP-1 RAs saw utilization jump to 24%, which drove up non-specialty drug trends by 1.1% alone. Navitus has implemented strategies to help plans balance the strong clinical benefits of GLP-1 RAs with targeted strategies, such as point-of-sale diagnosis checks, helping to manage the rapid upticks in utilization.

Specialty Therapies Are Reshaping the Pipeline

Continuing the trend seen in 2024, approximately 75% of new drug approvals in the coming years are expected to be specialty agents, adding a range of expenses across the entire drug pipeline. Knowing that these breakthrough therapies for oncology and rare diseases will continue to grow raises both affordability and long-term value questions.

Plans should proactively evaluate these high-cost, high-impact therapies from both benefits design and budgetary planning perspectives, or they may risk being surprised by what it does to their plan costs.

Prior Authorization and Utilization Are Evolving

Plans are evolving from blunt cost controls to more nuanced, data-driven utilization management that sustains access and maintains oversight. These strategies helped 30% of Navitus commercial clients spend less in 2024 than in 2023 – a notable feat, considering industry-wide prescription trend increases.

The 2024 trend was largely driven by increased utilization of new, more costly brand drugs. We saw a 26% increase in GLP-1 RA use for treatment of type 2 diabetes. While delivering significant clinical benefits, these medications are contributing substantially to pharmaceutical cost increases for benefit plans. To help plans address these issues, Navitus implemented a diagnosis edit, ensuring utilization for appropriate indications and resulting in an astounding 30% cost mitigation on GLP-1 RAs.

Why This Matters

In a market where drug spending is ever-increasing, the results from our 2024 Drug Trend Report aren’t just numbers. They’re evidence that transparency and proactive management can yield real, measurable results – without compromising member care. By studying the roadmap of the previous year, we can better define where we’re headed in 2025 and beyond.

So, if you’re looking to embrace innovation and manage costs, it starts with prioritizing transparency and data-driven oversight. And matching with a like-minded PBM partner is the best first step you can take.

Learn More

Visit the Drug Trend Report microsite for further insights and download the full report: navitus.com/DTR2024.

1 American Medical Association, Trends in Healthcare Spending. www.ama-assn.org/about/research/trends-health-care-spending#:~:text=Health%20 spending%20in%20the%20U.S.,%25)%20and%202021%20(18.3%25). Updated April 17, 2025. Accessed April 23, 2025.

Stay Informed and Connected

Receive expert insights, healthcare tips, and important updates on pharmacy benefits, drug recalls, and more—straight to your inbox.

Navigating with a trusted partner

Now Available: 9th Annual Drug Trend Report

Our Drug Trend Report provides a clear view of the trends shaping pharmacy benefits today, along with strategies that are delivering real savings without compromising care.